Manila, Philippines – In Filipino culture, showing up is the deepest expression of love. Whether it’s for birthdays, family milestones, or moments of grief, being present is everything. But what happens when you physically can’t be there?

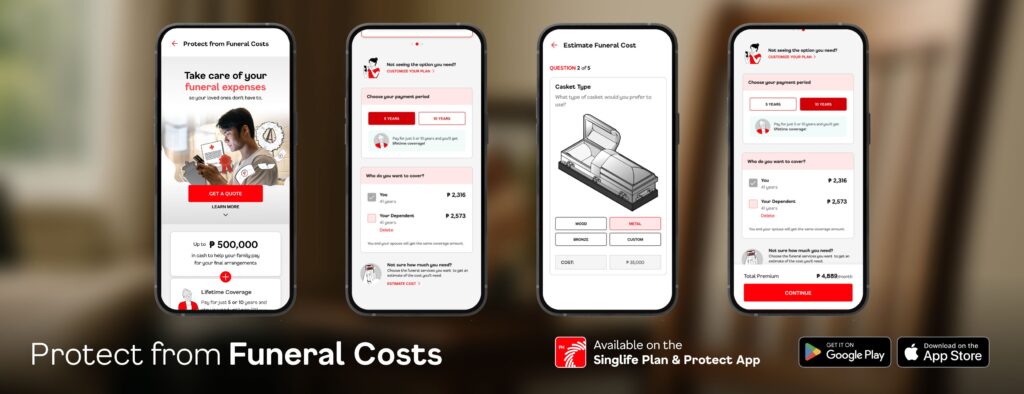

Singlife Philippines answers this with Protect from Funeral Costs, the latest product in its Singlife Plan & Protect App. This new whole life insurance offering empowers Filipinos to leave behind one last, meaningful act of love—to show up for those who matter most, even in their absence.

Available exclusively through Singlife’s fully digital mobile platform, this product provides a lump sum benefit of up to ₱500,000 to help families manage funeral arrangements and other end-of-life expenses, offering peace of mind for both policyholders and their loved ones.

“Losing a loved one is one of life’s hardest experiences. Sadly, many Filipino families also face the added burden of shouldering funeral costs through ‘abuloy’ or passing the hat,” said Lester Cruz, Chief Executive Officer of Singlife Philippines. “Protect from Funeral Costs lets you plan ahead and leave behind a final, thoughtful gesture—one that eases the financial worry of those you love most. It’s aligned with Singlife’s mission to empower every Filipino toward financial independence, both in life and beyond.”

Expanding the Singlife Plan & Protect App’s Growing Suite of Protection Products

This new offering joins Singlife’s portfolio of affordable, mobile-first life insurance and investment solutions, designed to put financial control directly in the hands of Filipinos. From life and medical coverage to investment-linked plans, Singlife continues to transform financial protection into something as easy and accessible as booking a ride or managing a savings account.

With funeral expenses in the Philippines often exceeding ₱200,000, Protect from Funeral Costs offers Filipinos flexible, accessible coverage to manage one of life’s inevitable yet often unplanned-for expenses.

A Flexible, Thoughtful Protection Plan

Protect from Funeral Costs is designed to give policyholders and their families both financial security and the freedom to personalize their farewell. Key features include:

- Customizable Coverage: Choose from ₱100,000 to ₱500,000 in coverage, with monthly premiums starting at ₱447. Pay for just 5 or 10 years and stay protected until age 120.

- Financial Needs Analysis Tool: Estimate your coverage needs based on your preferred funeral setup, casket, memorial lot, viewing days, and expected guests—empowering you to plan ahead and spare your family from unexpected expenses.

- Yearly Coverage Boost: Enjoy additional coverage annually at no extra cost when you keep your policy active, helping protect against inflation and rising funeral costs.

- Spouse and Child Protection: Extend your plan to cover your spouse or life partner, and even enroll your child starting from the second policy year at no additional cost.

- Waiver of Premiums for Disability: If you become permanently disabled while still paying premiums, future payments are waived while your coverage remains active.

- Cash Value and Loan Access: Build cash value over time and borrow against your policy starting in the fourth year for extra financial flexibility.

- Immediate Cash Assistance: Beneficiaries can access 10% of the cash benefit right away upon submitting the necessary documents, providing funds for urgent funeral needs while the remaining claim is processed.

Note: Yearly coverage boosts are based on non-guaranteed dividends and depend on market performance.

Because Love Doesn’t End — Even When Life Does

In a country where insurance penetration is still below 2%, Singlife Philippines continues to disrupt the status quo by offering relevant, mobile-first solutions that meet modern Filipino families where they are: on their phones, and in real life.

Protect from Funeral Costs transforms a once-taboo topic into a powerful, loving expression of care and foresight. Because even if you can’t be there, your protection still can be.

Now available exclusively on the Singlife Plan & Protect App, downloadable via the App Store and Google Play. New customers can also use the app’s Financial Needs Analysis tool to check how much coverage they need and receive an instant ₱300 in Singlife Credits to jumpstart their financial protection journey.

Because love doesn’t stop—even when life does.

Learn more about Protect from Funeral Costs here.